The Middle East and Africa (MEA) region has been identified as the region that offers the highest risk for investors due to social unrest, food insecurity, rising debt, and inflation, according to GlobalData, the data and analytics company.

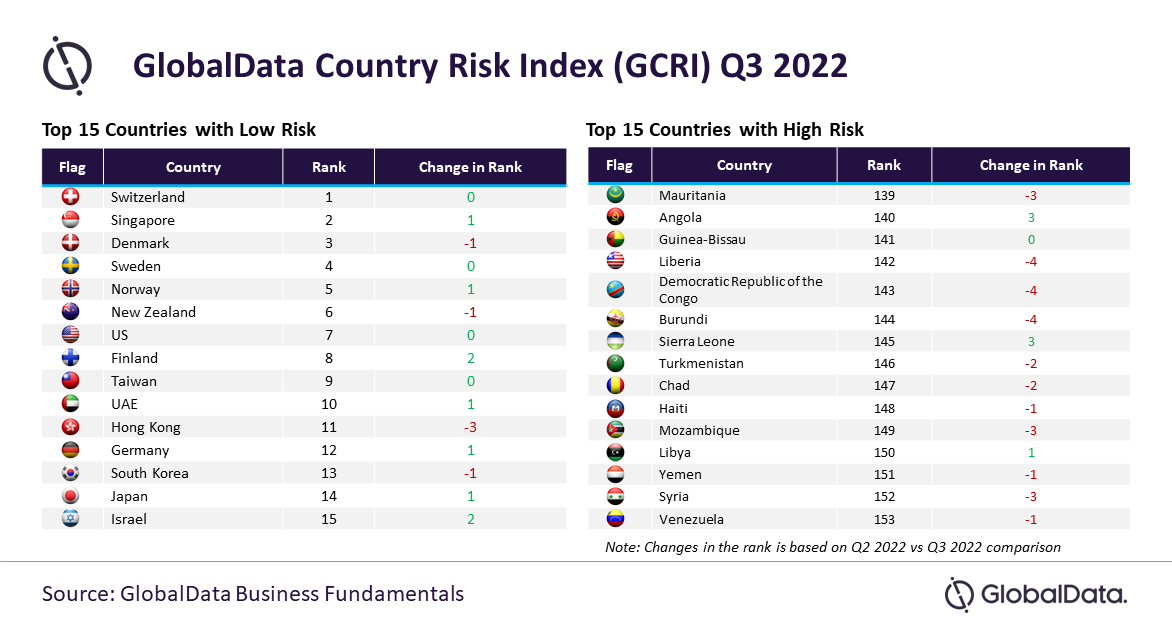

The research was conducted as part of GlobalData’s ‘Global Risk Report Quarterly Update – Q3 2022’ report, which outlines its Country Risk Index (GCRI). This model analyses a number of economic factors and calculates the amount of risk an investor accepts when doing business in each country and region worldwide. This is then represented by an overall ‘score’. The Americas region’s risk score was 54 out of 100 in Q3 2022, which is a whole 6.2 points above the Americas, which was the second highest in terms of investment risk. Next was the APAC region at 41, then Europe at 33.4.

Puja Tiwari, Economic Research Analyst at GlobalData, comments: “While rising oil prices has increased the revenue of major oil producers and exporters in the MEA, high fuel costs have adversely impacted low-income nations—especially given their heavy dependence on staple food imports from Russia and Ukraine.

Syria, Yemen, and Libya were on the list of the highest-risk countries in Q3.

Tiwari continues: “Humanitarian crisis across Lebanon, Syria, Iraq, Libya, and Yemen, along with skyrocketing poverty, is impacting the MEA region. Due to curtailment of wheat exports from two main producers in the world (especially wheat from Russia and Ukraine), many countries across the MEA are already facing major food crisis.”

Looking more broadly, GlobalData’s report highlights that global risk increased from 44 out of 100 in Q2 2022 to 44.9 in Q3 2022.

Tiwari adds: “The major causes of risk worldwide include the price rises as a result of the Russia-Ukraine war and sanctions on Russia, the energy crisis in Europe, a slowdown in China’s growth, aggressive interest rate hikes by central banks, depreciating currencies, and a crashing stock market.

“While governments of major economies are undertaking various fiscal measures to deal with the rising prices, this will weigh on already strained government finances. Moreover, with several economies tightening monetary policy, the increasing borrowing costs will remain another challenge moving into Q4 and beyond.”