Investors, regulatory bodies, industry advocates and guests advance the hotel ESG agenda

Hotel guests, investors, owners, employees, and brands worldwide are displaying a growing interest in responsible environmental practices, sustainable tourism, social welfare, corporate governance and transparency. The growing customer and employee expectations are driving the hotel industry to prioritize decarbonization initiatives, sound environmental stewardship and responsible social policies and practices.

On the environmental front, many large public hotel companies have already committed to meeting targets set by the Paris Climate Agreement1 to reduce greenhouse gas (GHG) emissions. Without broadscale change, it is estimated that average global temperatures will reach 1.5°C above pre-industrial levels in the next twelve years or so, significantly increasing the likelihood of severe, large-scale climate-related storms, heat waves and droughts.

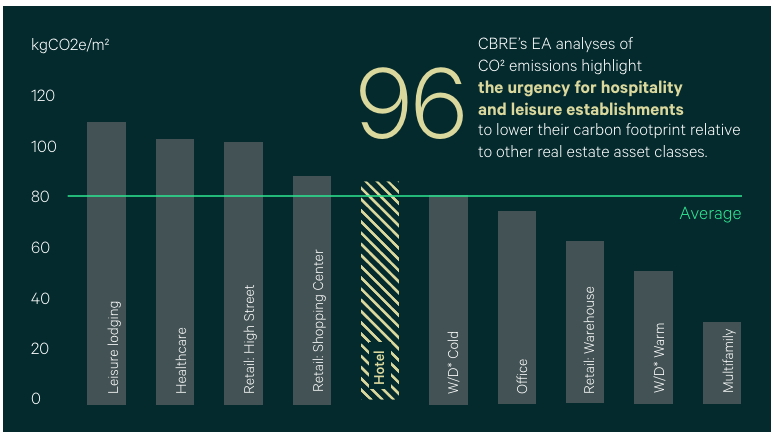

CBRE Econometric Advisors’ analyses of CO2 emissions highlight the urgency for hospitality and leisure establishments to lower their carbon footprint relative to other real estate asset classes. (Figure 1). The combination of an above-average carbon footprint and investors’ and guests' increased preference for environmentally sound hotels should accelerate the pace of improvement over the next few years.

This report provides a status update on ESG adoption in the hotel industry in the U.S., Asia Pacific, EU and the UK. It highlights examples of ESG-related initiatives and strategies pursued by hotel owners, operators and brands and identifies potential challenges and roadblocks to further implementation.

1 The Paris Climate Agreement is an international treaty that aims to respond to the threat of climate change by ensuring average mean temperatures this century do not increase by more than 2.0°C and to further pursue steps to limit any increase in average mean temperatures to under 1.5°C.

Figure 1: Global GHG emission 1.5°C reduction pathways from 2020 to 2050

Source: CRREM, CBRE Econometric Advisors, March 2023.

* Calculated using an unweighted average of sectors. (Lodging, Leisure & Recreation: Includes lodging, sports clubhouses, gyms, sports stadia, indoor sports arenas, halls, swimming pools, theatre, and auditoria. Hotel: Includes hotels, motels, youth hostels, lodging, and resorts).

** W/D – Warehouse/Distribution

The global ESG landscape

Hotel companies’ climate-related initiatives typically focus on four key areas: energy efficiency, carbon emissions, water conservation and waste reduction. While creating consistency in reporting on water, waste, energy and carbon emissions measurement metrics can be challenging, many hospitality brands have started utilizing Global Reporting Initiatives (GRI) and other standards such as European Financial Reporting Advisory Group (EFRAG) and International Sustainability Standards Board (ISSB) to set an internal framework for reporting standards. These reporting standards are helping hotel industry stakeholders understand and benchmark performance in relation to ESG targets.

Numerous third-party organizations are working with the hotel industry to develop research and tools that help hotels understand the climate impact of their operations. These include Greenview, an international consultancy that recently published a Net Zero Methodology guide to assist owners and operators with creating and implementing sustainability programs at the brand and property level to work toward a goal of net zero emissions by 2050.

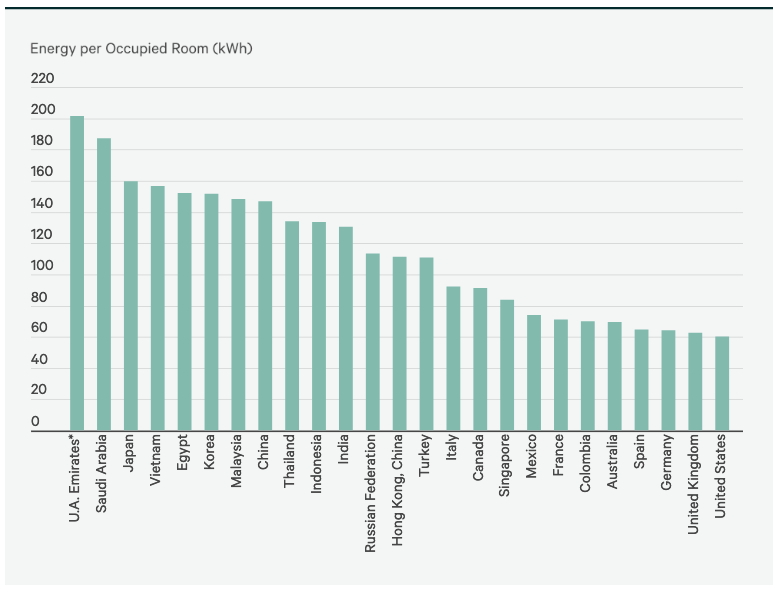

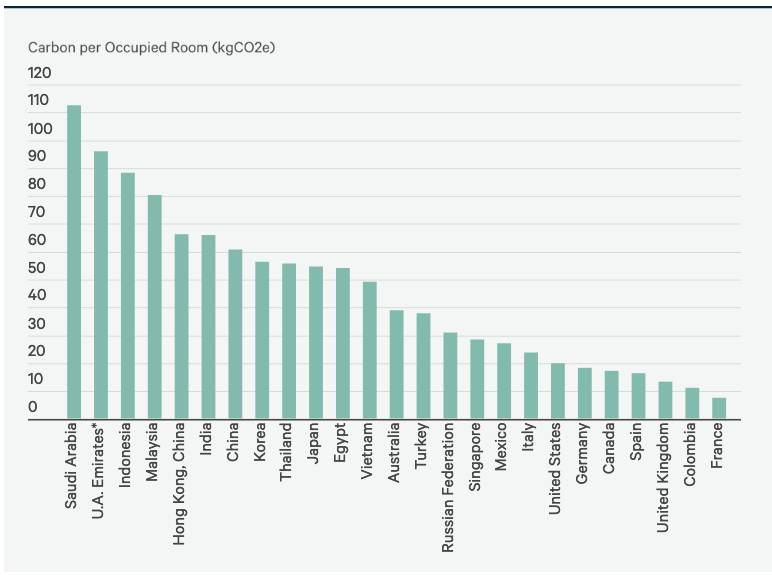

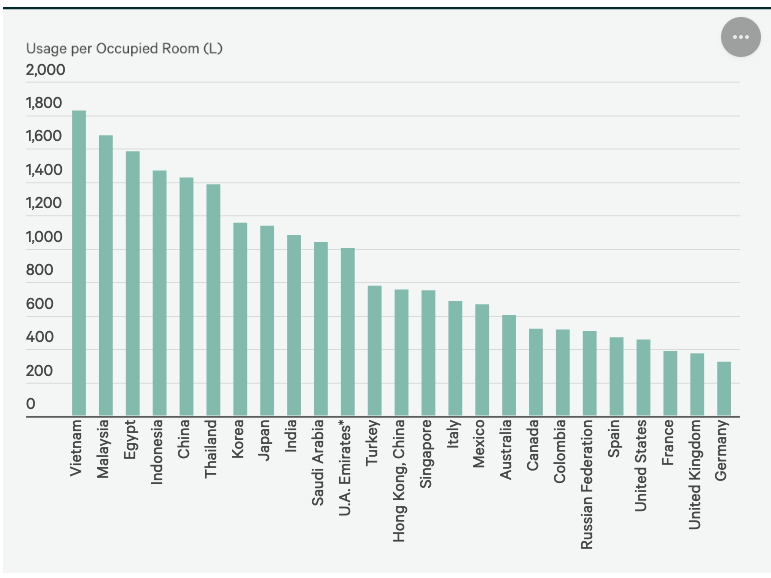

To track performance, The Cornell Hotel School, Greenview, and several others have developed the Cornell Hotel Sustainability Benchmarking Index. The Index allows hotel companies to benchmark their progress in different sustainability areas against their peers. The following data show energy efficiency, carbon emissions and water usage in 25 countries among hotels participating in the Cornell Hotel Sustainability Index.

Figure 2: Greenview top 25 countries’ average energy per occupied room (kWh)

Source: Cornell Hotel Sustainability Benchmarking Index, Greenview, 2021.

Figure 3: Greenview top 25 countries’ average carbon per occupied room (kgCO2e)

Source: Cornell Hotel Sustainability Benchmarking Index, Greenview, 2021.

Figure 4: Greenview top 25 countries’ average water usage per occupied room (L)

Source: Cornell Hotel Sustainability Benchmarking Index, Greenview, 2021.

ESG rules and regulations vary across different markets, with some countries more advanced than others in terms of introducing legislation to mitigate climate change, such as mandating that new construction and remodels meet strict regulatory requirements. While there are government programs and tax credits that can offset costs, in general expectations for financial payback will need to be extended from today’s typical 7 to 10 years.

Common ESG themes across all regions globally include:

- An increase in the number of benchmarking companies focused on measuring, quantifying and tracking carbon, waste, electricity and Diversity, Equity, and Inclusion (DE&I) levels at the property and organizational level.

- Robust commitments to science-based reduction targets and timelines.

- An increased focus on ESG effectiveness as an investment criterion.

- More initiatives to raise the number of diverse leaders in C-suite and board positions.

- Employee and guest bases that are increasingly focused on working for and patronizing hotel companies they believe are good environmental stewards and committed to the wellbeing of their associates, communities, and guests.

- Greater use of green financing options to improve the ROI on environmentally sound investments.

- A drive to implement waste reduction (single use plastics) and energy efficiency, which are seen as low hanging fruit for most hoteliers.

- Closer collaboration within the hospitality industry to reduce carbon emissions and meet sustainability targets involving organizations such as the Sustainable Hospitality Alliance (SHA), the World Travel and Tourism Council (WTTC), the Global Sustainable Tourism Council, and the American Hotel & Lodging Association (AH&LA). CBRE expects to see more independent hotel owners partner with these organizations to leverage energy-efficient technologies, minimize food waste, and remodel assets to improve their environmental performance. 3

- A growing emphasis on social goals. Organizations such as End Child Prostitution and Trafficking (ECPAT) are working with the hotel industry globally to advance causes such as ending human trafficking within the hospitality sector.

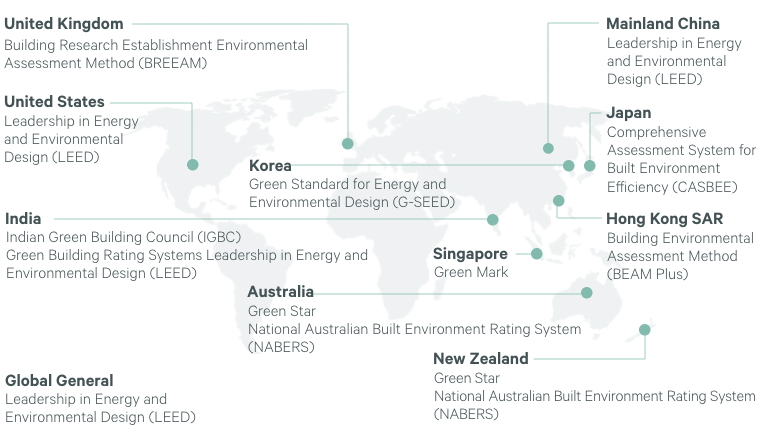

- Incorporating green building standards, systems and certifications to facilitate the implementation of sustainability initiatives globally.

3 This list is not intended to be exhaustive but presents some of the larger organizations supporting ESG initiatives in the hospitality industry.

Here is a snapshot of the green building standard landscape across major global regions.

Figure 5: Sustainability certifications across the globe

Source: CBRE Global ESG Survey, November 2022.

EU/UK

The EU is a global leader in tackling climate change and has introduced ambitious emissions-reduction targets.

Presented by the European Commission on December 11, 2019, The European Green Deal set the goal of making Europe the first climate-neutral continent by 2050. Under the initiative, EU member states have committed to reducing carbon emissions by at least 55% by 2030, compared to 1990 levels, and reaching climate neutrality by 2050. The European Commission has also created the EU Taxonomy, a regulatory body to assist in meeting climate and energy targets by 2030. These targets include an action plan for sustainable finance based on two new regulations dealing with taxonomy and financial disclosure regulations.4

The UK aims to reduce GHG emissions by 68% by 2030, 78% by 2035, and 100% by 2050. Achieving these objectives will require commercial real estate companies, including those owning hotels, to develop strategies to achieve a 94% reduction in CO2 emissions between 2022 and 2050 to ensure compliance with the Paris Agreement, which aims to limit the increase in average global temperatures to 1.5 °C.

4 Taxonomy Regulation establishes criteria for determining whether an economic activity is environmentally sustainable and includes additional product-level reporting requirements for products that promote environmental characteristics, which will help protect investors and lenders from greenwashing. Sustainable Finance Disclosure Regulation (SFDR) imposes transparency and disclosure requirements on firms and products.

5 UK Climate Change and Real Estate Key Facts, by M. Gibson – April 2022

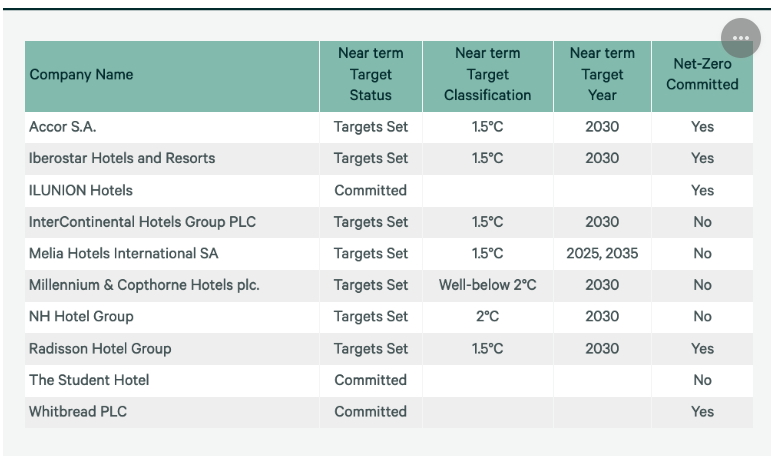

Figure 6: Major UK and EU hotel groups’ climate targets and net-zero goals

Source: Science Based Target Initiatives, March 2023.

CBRE expects mandatory disclosure requirements and high energy prices to incentivize swift action from hotel industry stakeholders in 2023, with failure to act leading to immediate and tangible impacts in the form of reduced energy efficiency, which could result in added pressure on profit margins. Moreover, failing to act in line with these disclosure requirements could result in financial penalties and greater capital investment within the later phase of the asset’s life cycle. Improving access to data and conformity in benchmarking will provide greater insight into how sustainability affects value, allowing better-informed decisions on the issue.

While hotel operators in the EU and UK are focusing heavily on improving their social and governance performance, hotel owner-operators are striving to optimize the balance between all three elements of ESG when assessing their rate of return on any investments.

Fundamentally, the short-to-mid-term ESG actions of owners, operators, or brands will directly impact their brand and company’s reputation. By acting now, stakeholders can avoid falling behind their competitors and minimize reputational risk.

Although hotels in the EU and UK continue to grapple with high energy prices and rising operating expenses, properties with better energy efficiency are more resilient to the impacts of energy rate increases, which can mitigate budgetary uncertainties. Individuals investing in hotels are increasingly assessing the impact of sustainability initiatives on both net income and yield.

Hotel investors in the EU and UK are increasingly cognizant of the fact that improving energy efficiency can reduce costs and limit exposure to fluctuations in energy prices and are therefore keen to invest in these areas. Investors generally are willing to pay more when ESG risks are well managed.

In addition to minimizing brand and company reputation risk, more investors in these markets are assessing physical and transitional climate-related risks. Steps include identifying the most at-risk buildings and preparing them for retrofitting and adaptation. Resources for investors include the Carbon Risk Real Estate Monitor (CRREM), an initiative that provides the industry with appropriate science-based carbon reduction pathways at the building, portfolio, and company level and financial risk assessment tools to manage carbon mitigation strategies cost-effectively.

6 Acute physical perils such as flooding, wildfires, hurricanes could cause damage to hotel assets and business interruption. Chronic physical perils such as drought, water stress and extreme temperatures created by longer-term shifts in weather patterns often result in increased operational costs for hotel owners or could even remove the ability to operate at all.

Asia Pacific

Climate-related legislation and initiatives in Asia Pacific are being driven by developed countries, with Singapore and Australia among the leaders.

In November 2022, Singapore announced it would raise its carbon tax for GHG emissions to S$25 (US$19) per tonne in 2024 and 2025 and S$45 (US$33) per tonne in 2026 and beyond. The country also plans to establish a framework for International Carbon Credits (ICCs), tradable certificates representing reducing or removing emissions from the atmosphere generated from projects or programs outside Singapore. Currently, Singapore’s S$5 (US$4) per tonne carbon tax rate applies to facilities that directly emit at least 25,000 tCO2e of GHG emissions per year, which includes many hotels. While the drastic nine-fold increase in tax levels may appear material, CBRE estimates the impact on hotels’ net operating income to be around 1%.

In Australia, the National Australian Built Environment Rating System (NABERS) provides sustainability measurement tools for real estate assets, including hotels. NABERS includes ratings for energy, water, waste, and indoor environmental performance to help hotel owners benchmark and understand their property’s performance relative to comparable hotels. Green Mark, a Singapore-based rating and certification system, and Building Environmental Assessment Method (BEAM) Plus, a Hong Kong-based rating system, provide similar comprehensive frameworks for the environmental performance of both new and existing real estate, including hotels.

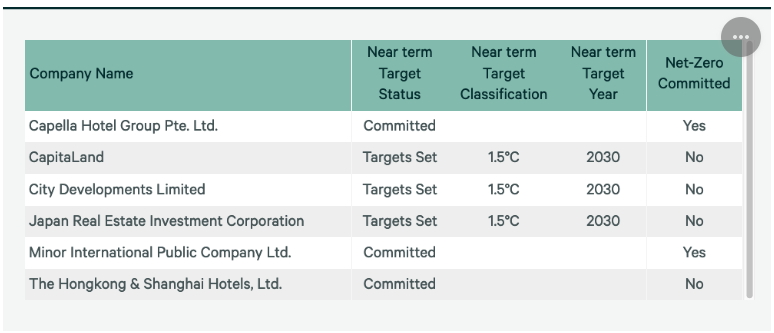

Figure 7: Major Asia Pacific hotel groups’ climate targets and net-zero goals

Source: Science Based Target Initiatives, March 2023

The incoming generation of hotel owners and developers in Asia Pacific is increasingly focused on incorporating ESG practices. Online Travel Agencies (OTAs) are also active in the ESG sphere by placing business based on environmental certifications obtained, such as GSTC and ISO14001. Among operators, the removal of single-use plastics is one of the top agenda items.

Larger hotel companies in Asia Pacific have pledged to reduce scope 1 and 2 emissions, with a few starting to set out scope 3 emissions targets as they look to achieve net zero emissions. Reducing scope 3 emissions will rely on identifying ways to decrease carbon in the supply chain.

Cybersecurity best practices are key to achieving governance objectives and educating operators and employees. In addition, data and privacy protections are paramount for hotel operators who feel that current operating models are vulnerable.

Social initiatives in Asia Pacific impact three key categories of people – communities, employees, and partners. The hotel industry’s social objectives typically comprise wellness, DE&I, income inequality, and employee compensation. Priorities include promoting women to hospitality c-suite positions and providing greater employee benefits, including paid parental leave.

Corporate social responsibility and sustainability are built upon governance within hotel companies in Asia Pacific. Governance affects how resources are utilized and ensures companies comply with laws and regulations. Transparency in ESG reporting on overall waste and emissions is key, with failure to do so properly potentially resulting in penalties from ESG regulators.

While green financing and sustainability bonds are enticing for Asia Pacific developers adopting environmental strategies, minimum project costs of around US$100 million are typically needed to pursue such approaches.

U.S.

While the SEC’s draft regulations could place new requirements on public companies, including hotel owner-operators, external stakeholders have been a more immediate catalyst for advancing carbon reduction programs. Recently, however, the U.S. government’s Federal Supplier Climate Risks and Resilience Rule requires federal contractors to disclose greenhouse gas emissions and climate risks and set science-based emission reduction targets. This ruling could have a trickle-down effect on other industries, including hotels and companies working with the same suppliers.

In terms of regulatory incentives and support, the US Department of Energy has created the Better Buildings Challenge, which is a voluntary leadership initiative to encourage, educate and support small hotel owners and operators to take the initiative in reducing energy consumption and water waste.

Investors that want more information about sustainability and climate impact guidance, regulations, and incentives for commercial real estate in the U.S. often look to local-level governing bodies, such as state, city, and in some cases, county officials.

Compliance with the ever-increasing state and local government building performance standards (BPS) will ensure that high-energy-intensity buildings progressively become more energy efficient and, therefore, less carbon-emitting over time. Some jurisdictions have hefty penalties for non-compliance.

Figure 8: Major North American hotel groups’ climate targets and net-zero goals

Source: Science Based Target Initiatives, March 2023.

With DE&I becoming a significant focus for U.S. companies, hotel industry stakeholders are prioritizing guest and employee well-being and fair labor practices, specifically hiring, to ensure diversity among staff, executives, and suppliers.

On the social front, the Department of Homeland Security’s Blue Campaign and corresponding Hospitality toolkit seeks to raise awareness about human trafficking and provide resources on recognizing and reporting human trafficking incidents, particularly at hotel properties. Hotel companies and organizations are continuing to commit to fighting human trafficking, with the American Hotel and Lodging Association’s (AH&LA) No Room for Trafficking program reiterating the industry’s collective promise to take anti-trafficking measures to prevent and combat human trafficking. Third-party organizations and NGOs such as ECPAT US provide news, resources, and guidance on preventing child trafficking in the travel industry.

Company ethics and transparent reporting on environmental and social issues have become a pillar of corporate governance. Many large hotel companies in the U.S. have board committees that oversee the direction and implementation of ESG goals.

Companies are increasingly using their own proprietary systems for implementing and monitoring ESG initiatives. Examples include Hersha’s EarthView, Hyatt’s EcoTrack, Hilton’s LightStay, Wyndham’s Green Toolbox, and IHG Green Engage.

Conclusion

The global hotel industry’s commitment to sustainability and ESG issues will continue to grow, driven by new regulatory regimes that require companies to move down the path to net zero.

While many hotel brands, owners and operators have pledged to improve ESG performance and reach net zero targets, slower economic growth in the EU, UK and Asia Pacific as well as an anticipated recession in the U.S. could slow near-term progress.

Other challenges such as persistent inflation and high interest rates and increased geopolitical uncertainty could prompt capital-constrained hotel companies to delay ESG initiatives and draw out their implementation timeline.

Hotel industry stakeholders would be well served to familiarize themselves with the ESG legislation, initiatives and trends discussed in this report, and draw on the right resources and expertise to formulate and execute ESG strategies.

This article originally appeared on CBRE.