The latest 2023 APAC hospitality statistics, including exclusive TrustYou and third-party data.

TrustYou APAC Hospitality Statistics Q1 2023

#1 Review Volume Increases Significantly

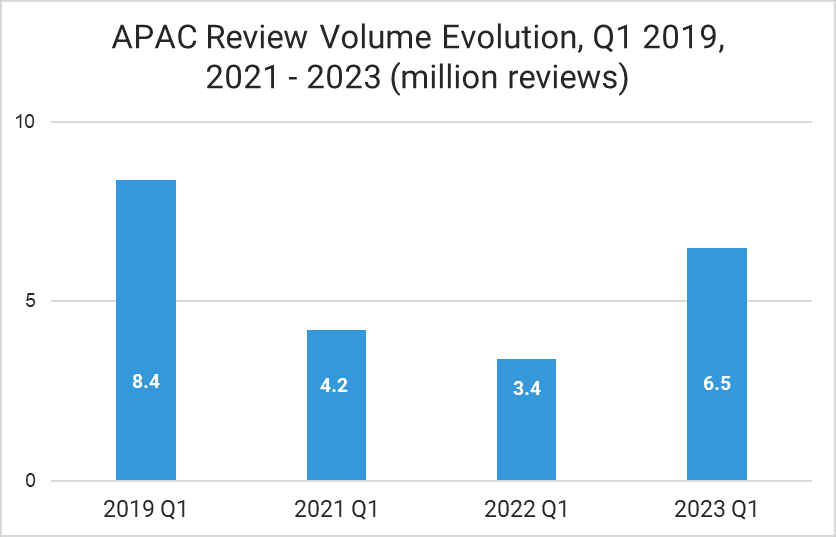

Q1 2023 APAC review volume reached 77.4% of the pre-pandemic level and recorded a 91.2% increase compared to Q1 2022.

In Q1 2022, the review volume was 41.1% of the total 2019 reviews. The review volume could surpass pre-pandemic numbers by the end of 2023 at this accelerated pace.

APAC Review Volume Evolution, Q1 2019, 2021-2023

APAC Review Volume Evolution, Q1 2019, 2021-2023

A growing appetite for travel confirms this accelerated growth. Skyscanner’s report shows a 701% increase for Q1 2023 in year-over-year global searches from APAC travelers, the highest growth recorded globally.

#2 Positive Feedback is Steadily High

93% of APAC guest reviews are positive.

Same as in 2022, this number proves that APAC hoteliers are committed to offering excellent service and listening to their guests’ needs.

#3 Service Improves Scores; Room Brings Lower Ratings

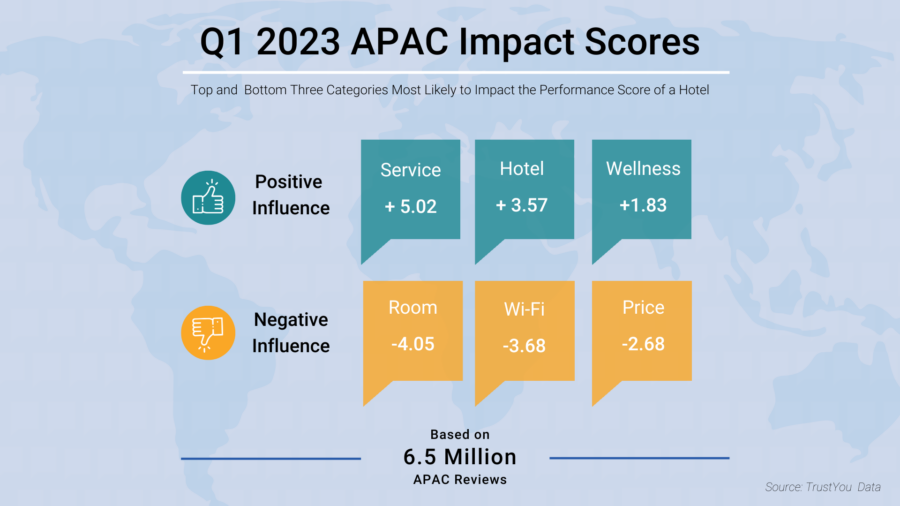

APAC Impact Scores follow similar patterns to the 2022 categories and subcategories.

TrustYou’s Q1 2023 APAC Top and Bottom Impact Scores Influencing the Performance Score of a Hotel

TrustYou’s Q1 2023 APAC Top and Bottom Impact Scores Influencing the Performance Score of a Hotel

Wellness services are a specific factor in the region that also brought higher scores in 2022. APAC and the US are the only regions where Room is the first in the top negative categories. With relaxation measures being implemented throughout 2022, cleanliness remains a top priority, reflected in the category Room.

For Service, what mattered most for guests in Q1 2023 was interacting with friendly staff and helpful management. Travelers particularly appreciated WaterPark and WinterPark Hotels. As for wellness services, hotels were more likely to receive higher scores if they had specific services such as spas or access to hot springs and if the designated staff was helpful.

Room maintenance and bathroom were most likely to bring lower scores for the category Room. A slow and unstable internet connection was also crucial in decreasing scores. APAC guests weighted the value for money during a stay, and if it didn’t correspond to their expectations, they were more likely to leave lower evaluations. Another crucial factor in the category Price was food prices.

Industry Wrap-Up - APAC Hospitality Statistics Q1 2023

#4 Top Q1 2023 Destinations

The recent report by Skyscanner looks at search patterns from Q1 2023. APAC travelers still want to explore their region first - 7 out of 10 destinations included in the list are from APAC.

While Taiwan registers the highest increase, Japan holds the highest search volume. “Everywhere” is an option that Skyscanner offers for travelers who want to get some inspiration and includes worldwide destinations.

While Taiwan registers the highest increase, Japan holds the highest search volume. “Everywhere” is an option that Skyscanner offers for travelers who want to get some inspiration and includes worldwide destinations.

#5 Spotlight on China: Domestic Travel on the Rise

The lift of the Zero-COVID policy at the end of 2022 brought China's first signs of travel recovery. According to the Chinese Ministry of Culture and Tourism, domestic trips increased by 46.5% in Q1 2023 compared to last year.

A complete return of Chinese travelers to the international scene will likely happen gradually. Economic pressure, fueled by the housing crisis and COVID-19, is among the main reasons Chinese consumers do not travel abroad. As a result of prolonged lockdowns, traveling behaviors also changed. Chinese consumers prefer to schedule their trips at shorter notice, worried about possible disruptions related to the pandemic. Health & safety is a primary concern. Therefore, tourists are more likely to travel in smaller groups and choose sustainable options.

Going local is the first choice for Chinese travelers, followed by nearby countries. Among the top destinations in 2023, the first is Hong Kong (20.7%), followed by Macao (11.4%). Thailand is the third choice and first outbound destination (11.1%).

Going local is the first choice for Chinese travelers, followed by nearby countries. Among the top destinations in 2023, the first is Hong Kong (20.7%), followed by Macao (11.4%). Thailand is the third choice and first outbound destination (11.1%).

The desire to travel internationally will increase gradually this year, with the younger generations expected to break the traveling pattern sooner. Dragon Tail’s survey confirms that the overall demand will rise starting in July, with 42% of those surveyed planning to travel between July-August and 32% planning their trips for the Mid-Autumn Festival / National Day at the end of September to the beginning of October.

While consumers’ sentiment towards international destinations may quickly change this year, the Chinese authorities are dealing with other restraints that may slow down outbound travel. After three years of standstill, the airline industry is not prepared to fully return to pre-pandemic levels and ensure the necessary seat capacity. In the first months of 2023, a limited number of flight destinations were available at very high rates, and this is expected to continue throughout the summer.

All these factors point to a gradual comeback of China on the international travel scene. An analysis by Oxford Economics points out that China’s outbound travel could reach 48% of 2019 levels. As with the other countries and regions reopening their borders after the pandemic, a full recovery will most likely be possible over a more extended period.

#6 APAC Snapshot

South Korea registered a year-over-year increase of 51% in hotel bookings from March 15th - June 30th. Arrivals from Europe (UK, France, Italy, Spain, and Germany) registered a 456% growth year-over-year.

New visa rules are slowing the recovery process in Vietnam. Since the country reopened, travelers must apply for a visa in advance. The visa-on-arrival procedure applies now only for visitors traveling on tour with a local operator. The new rule caught a lot of travelers by surprise. Unclear communication from Vietnamese authorities lead to a considerable number of rush applications. In 2022, international arrivals to Vietnam recorded an 80% decrease compared to 2019. Neighboring countries registered a better performance. Thailand had 72% fewer visitors, and Cambodia had a 65% decrease compared to pre-pandemic levels.

India started strong this year. February international arrivals recorded a 254% increase compared to 2022 and only 20% behind 2019.

Thailand exceeded its Q1 2023 arrival target. The country welcomed 6.15 million tourists between January - March 2023. The authorities initially set a target of 6 million tourists. Overall, Thailand expects between 25-30 million international visitors this year.

More than 2.9 million travelers visited Singapore in Q1 2023, which equals 62% of 2019 levels. The length of visit extended slightly compared to pre-pandemic levels. The Singaporean authorities are working on a comprehensive strategy to strengthen the tourism sector. Among key areas, the destination seeks more visibility through entertainment content. To confirm its top position as a MICE destination, the Singapore Tourism Board is working with various global tourism organizations to define the first sustainability guidelines for the MICE and attractions sectors.

Use Guest Reviews to Attract More Happy Travelers

Happy travelers spend more, book again, and promote your brand. How do you increase your visitors' satisfaction as a hotel, destination, or booking platform?

TrustYou offers a powerful tool for the hospitality industry that helps attract more visitors and improve guest satisfaction. With the help of our all-in-one reputation management platform, you can collect and analyze feedback from guests, identify improvement areas and address issues promptly. This leads to increased guest satisfaction, positive reviews, and, ultimately, more bookings. Our guest experience solution platform allows you to engage with guests before, during, and after their stay, fostering a sense of connection and building trust.

*The requested Q1 2023 top and bottom Impact Scores reflect the main semantic categories.

** Q1 2023 Impact Scores and Review Volume were requested at the beginning of April 2023. Due to the dynamic nature of the database with reviews and hotels being updated, the numbers may vary if data were requested at an earlier or later stage.

***the report includes rounded numbers for a clearer data representation.

Catalina Brinza

Catalina is a social media and data enthusiast. At TrustYou, she's on the mission to bring the most out of travel and hospitality data. One day, she hopes to experience Japan's culture to its fullest.

About TrustYou

TrustYou is on a mission to make guest communication and feedback simpler and more productive. All communication channels, together in one place, is the new way of doing business. Today, customers expect instant responses on their preferred communication channels. As a subset of communication, feedback is the foundation to build better products, services and companies.

TrustYou helps companies win through the power of listening and provides a Guest Experience (GX) Platform that makes listening to customers easy, powerful, and actionable. The platform unlocks the potential of guest feedback and helps to:

- Create unlimited opportunities to listen and respond to guests’ needs.

- Understand all reviews across the web and make better business decisions.

- Publish hotel reviews on the website and on Google and allow positive feedback to influence bookings.

TrustYou empowers companies to earn trust, make better decisions, and ultimately, win.

Find more information on TrustYou and our GX platform on www.trustyou.com.