Excerpt from CoStar

Hotels in urban markets have yet to fully recover to pre-pandemic levels of group occupancy and rates, while resorts and suburban hotels have surged ahead.

As summer in the Northern Hemisphere wanes and peak leisure travel season comes to an end, hoteliers hope a recovery in group demand will pick up the slack.

It's anyone's guess when business travelers and large groups will return to hotels at their historical norms. But hotel revenue managers can examine the booking patterns of today's group business to drive future bookings and rates.

During a data presentation titled "Group Size Matters" at the recent Hotel Data Conference, Emmy Hise, CoStar Group's senior director of hospitality analytics, shared some performance metrics of group-business-oriented hotels with varying meeting space. The data set compared trailing 12-month performance through June 2023 to the same period in 2017, which Hise said is an exact calendar match to 2023 in terms of how holidays fell.

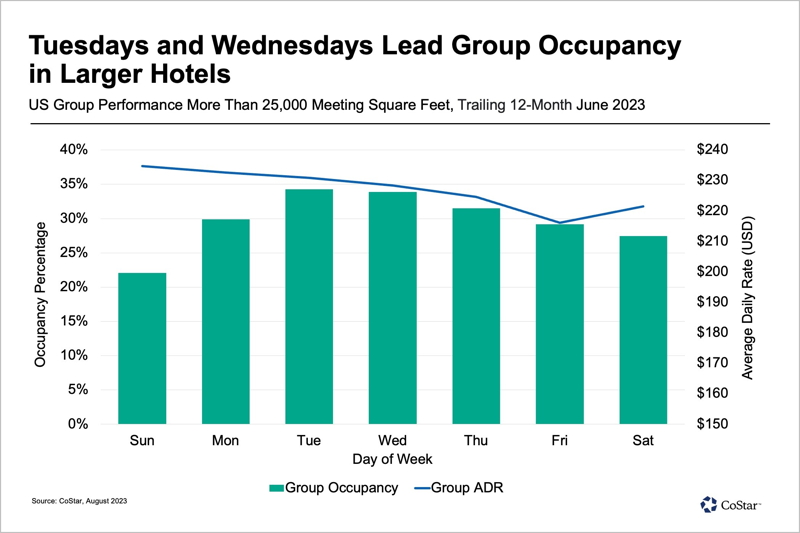

Of note, group occupancy appears to be fairly consistent Tuesday through Sunday for hotels that have 25,000 square feet of meeting space or less. But in hotels with greater than 25,000 square feet of meeting space, Tuesdays and Wednesdays had higher group occupancy than the other days of the week.

Regardless of hotel size, group occupancy on Sundays was down the most, which Hise said isn't surprising. Still, average daily rates for group demand were high, even with lower occupancy in the segment on Sunday nights.

"As hoteliers, a lot of us have learned that dropping rate doesn't necessarily induce demand. We might as well keep rates where they are and we will have lower operating expenses at a lower occupancy," Hise said.

She added that business travel for meetings or events is less likely on Sundays, unless travelers have the advantage of adding a day or two onto a business trip for some leisure purposes, which the industry refers to as "bleisure" travel.

"People covet their personal time now. They do not want to travel on a Sunday for a meeting," Hise said. "They want that personal time, unless they are coming for bleisure [and] they are making a longer stay."

There was a noticeable decrease in transient room rates between Saturday and Sunday at these hotels, and Hise said it's likely that slightly lower room rates could do more to convince leisure travelers to book Sunday nights than they could group business travelers. That might explain why group rates stayed high on Sunday nights, consistent with the other nights of the week.

"But why drop the group rate? Let's just keep it up because we know even if [guests are] kind of sneaking in on that group rate, keep it at closer to where that transient rate is so we're capitalizing on the rate overall," she said.

Click here to read complete article at CoStar.