Mainland Europe is a hub of activity throughout the summer months with millions of global travelers flocking to key destinations for a mixture of sun, culinary delights, and culture. The consistently strong demand allows hoteliers in key summer destinations to strategize with confidence. This summer, however, there is one destination that has exceeded all expectations. The following analysis highlights how Italy’s hotel sector is thriving in bookings and room rates in addition to assessing how online trends set up a summer to remember for Italian hoteliers.

Record-breaking rates

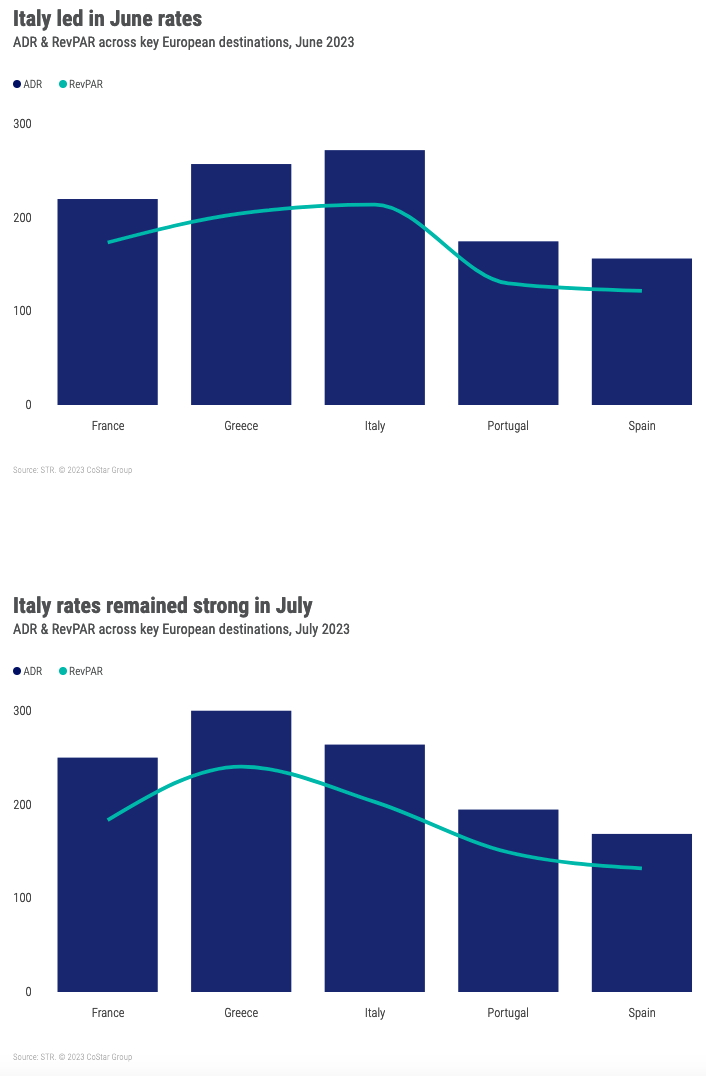

Across Europe, certain key markets and countries can rely on consistently strong demand from June through August. Recent proof can be seen in strong monthly occupancy levels achieved in June and July across France, Greece, Italy, Portugal, and Spain. These key markets achieved occupancy levels ranging from 74% to 80% in June and 73% to 80% in July, an indication of high demand as well as a relatively even split of guests across Southern and Western Europe.

The top-line revenue metrics are where Italy’s true success becomes evident though. The country recorded an average daily rate (ADR) of EUR271.84 in June and EUR263.89 in July, which was in stark contrast with Italy’s neighbors to the west, as Spain secured rates of EUR156.24 and EUR168.64. Revenue per available room (RevPAR) also impressed at a country level with Italy reaching EUR213.80 in June and EUR202.86 in July. Greece fell closely behind in June at EUR204.47, however, surpassed Italy in July at EUR240.52.

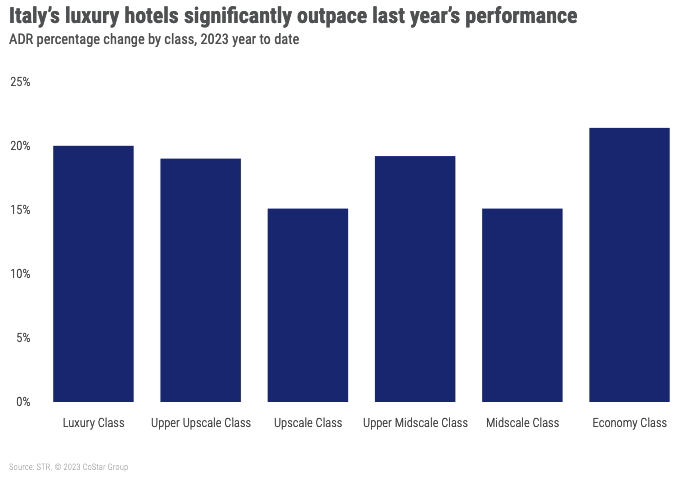

Digging deeper, rate is the driving force behind positive revenue performance in Italy’s luxury class properties. Revenue managers at high-end properties were able to command ADRs of EUR978.65 in June and EUR1,031.85 in July, representing respective uplifts of 26.6% and 22.8% from the previous year. Much of that gain can be associated with the return of travelers from the United States, one of the biggest spending groups on European luxury travel.

Interestingly, properties at the opposite end of the spectrum, Italy’s economy class, have posted the segment’s highest ADR (EUR87.96 in June, EUR81.45 in July) across the key destinations included in this analysis. This means that as rates have risen across all property types, more budget-conscience guests have turned toward more affordable accommodation. In turn, properties lower on the chain scale have pushed rates thanks to higher demand.

Bookings started to pick up early in 2023

Forward STAR provides insight into future demand. Looking at key tourism markets in Italy, we see how occupancy on the books has built up leading into June, July and August. Bookings at the end of 2022 were relatively low across five key Italian markets, with only a select few dates creeping over 20% occupancy on the books. Fast forward to the start of 2023 and a clear uplift in demand was seen across each of these destinations, with Florence being a prime example at 44% occupancy on the books as of 6 February.

As the months continued to roll in, demand across all markets grew. By May, it was the leading tourist destinations of Florence and Rome that had the largest proportion of rooms sold. Yet at periods in July, the Italian Islands managed to grab the top spot in relation to future booking levels.

On trend

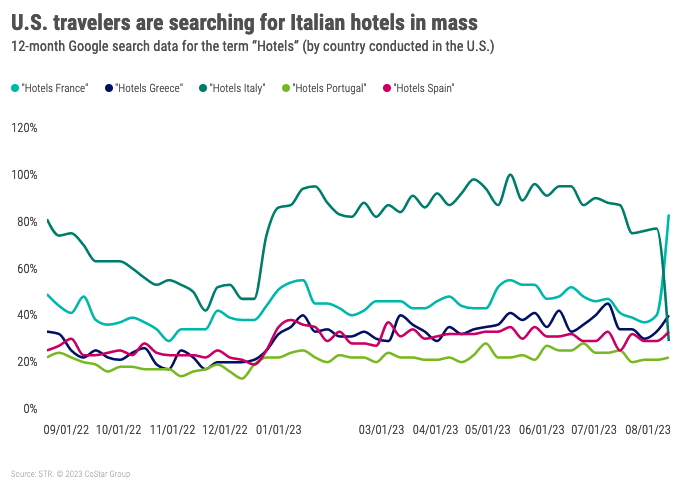

From the data presented above, the success enjoyed by many Italian hoteliers throughout the summer of 2023 is abundantly clear. This data can be further supported through the examination of online trends. Specifically, Google trends highlight just how much global travelers have been chasing the notion a dream Italian summer.

At a global level, several search terms have leapt up over the course of the last 12 months. “Italy tour packages” has risen 300%, “cheapest time to travel to Italy” is up by 200% and “best way to travel in Italy” is up 170%. Typically, niche search terms have also risen drastically such as “Taormina,” which reached peak search popularity across the last five years on 6 August. This is very likely to be associated to increasing film tourism demand following the success of the HBO series “The White Lotus”, in which this small Sicilian commune plays a key role in the storyline.

This summer, the U.S. has been responsible for delivering some of the largest numbers of arrivals to Italian hotels. To get a sense of where this level of demand sits in relation to other key European destinations, Google trends data can help to provide an indication. When comparing the search for “Hotels” across France, Greece, Italy, Portugal and Spain, those traveling from the U.S. have a clear favorite.

Are rates here to stay?

The big question for those in the Italian hotel sector is how sustainable are the current room rates? STR and Tourism Economics forecast modest ADR declines for Rome and Milan in 2024 on the basis that pent-up demand, U.S. travel supported by a strong U.S. dollar, and high inflation have pushed summer 2023 rates a bit higher than is sustainable. Demand will grow next year, but rates will “reset” and decline modestly as the dollar depreciates, U.S. slows economically, inflation moderates across Europe, and normalized demand growth slows pricing power. However, the fact remains that Italy is and will always be a key location for both short-haul and long-haul leisure travelers. Although the rates of summer 2023 may not be the norm, the appeal and popularity of this small Mediterranean nation is likely to drive strong hotel performance for the foreseeable future.

This article originally appeared on STR.